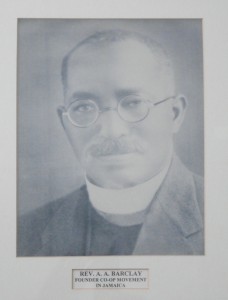

In 1924, the Rev. A.A. Barclay of Lucky Hill in St. Mary has an idea. Why not form a cooperative for banana growers, so that small farmers could negotiate sustainable export contracts like the big planters? A year later, while this cooperative is still in its fledging stages, the Reverend has another idea. Why not do the same for other agricultural products and market them all through a parent organisation?

With this ingenuity and the assistance of F.H. Robertson a relentless banana advocate, along with Members of the Legislature, several Custodes and the farmers themselves, the Jamaica Producers Association (JPA) is formed.

- Sir Arthur Farquharson

- Charles E. Johnston

- Cpt. S. D. List

The Jamaica Banana Producers Association (JBPA) is one such independent cooperative under the JPA. Although born on April 1, the JBPA soon proves that there is nothing foolhardy about its formation. Its key leadership, Sir Arthur Farquharson, Charles E. Johnston and Cpt. S. D. List had significant expertise in farming, law and shipping. With capital of £173.60 and a membership of 6,145 growers, they embark on an audacious journey to compete successfully with the foreign owned fruit multi-national companies, for the shipping and marketing of Jamaican bananas.

Important support comes from the Pringle family, the largest banana producers in Jamaica at the time. They lead the way for others to follow by contracting all their fruit to JBPA. The cooperative is off and running.

At this time, the famous “banana boat” is not only essential to the export market but for passenger travel to and from England. As luck or serendipity would have it, F.H. Robertson first General Manager of the Jamaica Producers Association (JBPA) goes on a family vacation to the United Kingdom (U.K.) which he turns into a rigorous investigation of the banana trade from that end. His resulting report which highlights many issues is instrumental in outlining the urgent need for JBPA’s own shipping line.

Jamaica Banana Producers Steamship Company, a wholly owned subsidiary of the cooperative, is soon after incorporated, making the JBPA owner of a steamship line consisting of four refrigerated ships: Jamaica Producer, Jamaica Merchant, Jamaica Planter and Jamaica Settler.

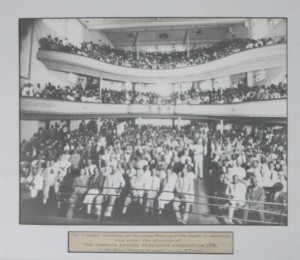

The Crowded audience at the Great Meeting of the People of Jamaica held under the auspices of The Jamaica Banana Producer’s Association Ltd. in the Ward Theatre, Kingston, on July 18th, 1935.

For six years the ambitious and valiant fight to ship and market Jamaican bananas in the U.K. continues, but the competition is relentless and beyond the means of a mere cooperative. Unless there is some Government intervention, the writing is on the wall.

This leads to a large public meeting at the historic Ward Theatre in downtown Kingston. A resolution, followed by a petition to the Secretary of State of the Colonies and a subsequent Commission, ultimately lead to an agreement between the chief competitors the United Fruit Company and the JBPA. Under this agreement both parties would become “friendly” competitors, ensuring the stability of the industry.

To achieve this, the JBPA becomes a joint stock Company with shares allotted to members according to the value of their original holdings in the cooperative.

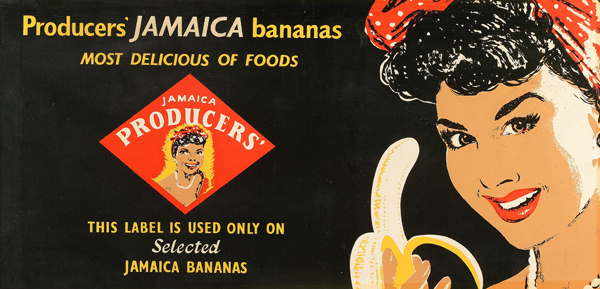

By 1937 the work of the JBPA has borne real fruit. Banana exports have skyrocketed to an all-time high of 360,000 tons, claiming 50% of the value of the island’s total exports.

New refrigerated ships are purchased to gradually replace the original ships. They all bear names that make no mistake about their nationality: Jamaica Producer II, Jamaica Planter II, Jamaica Pioneerand Jamaica Progress.

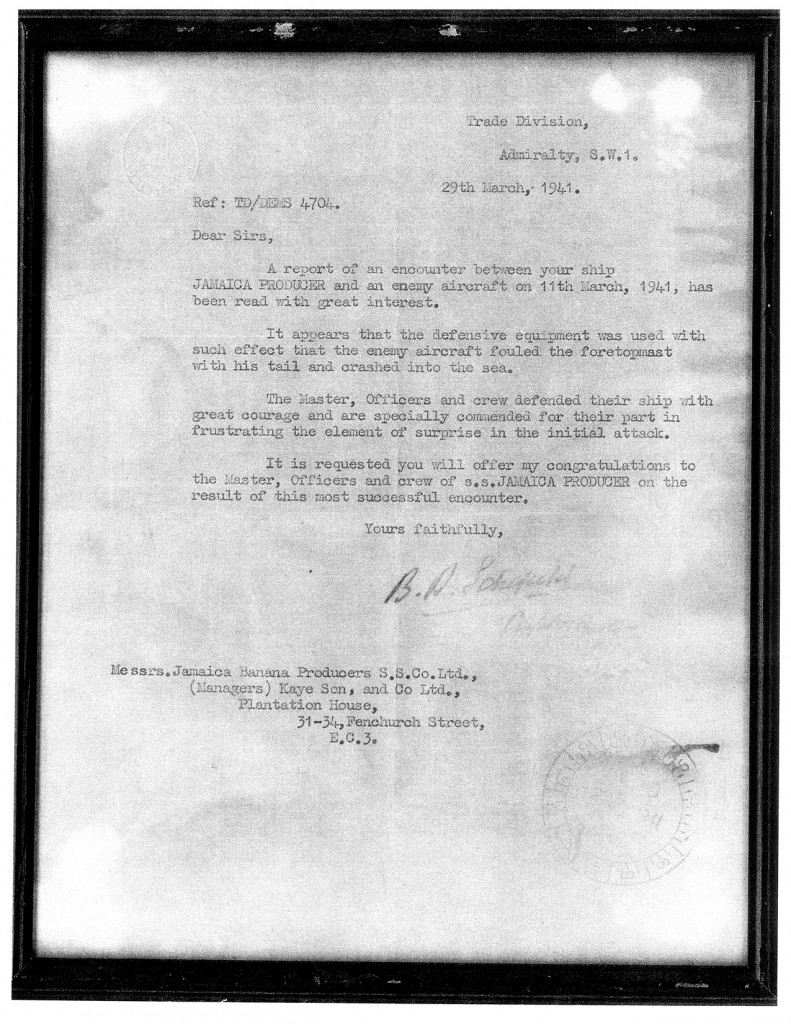

The Second World War proves devastating for the banana industry as commercial sales of bananas to the UK cease abruptly. The JBPA’s fleet of ships are all pressed into war service, playing their part in delivering food to the U.S.A. and the U.K. The lone survivor however is the Jamaica Producer II which provides a bit of notoriety for the JBPA shipping line, earning the distinction of having shot down a German Stuka Bomber in the English Channel while under attack.

An unnamed hurricane adds to the woes of planters, with many farms decimated. The company is down but not out and the interests of the farmers are deemed of paramount importance. Dividends of 2 1⁄4 d. per share are paid to the farmers to aid in their recovery.

In addition, the formation of the All Island Banana Grower’s Association during the war helps to give farmers a greater say in how the industry is managed going forward.

Hon. C.H. Browne is appointed Chairman of the JBPA and has the unenviable task of restoring stability to the industry.

Meanwhile the annual task of negotiating the price paid for Jamaican bananas in the U.K. as well as shipping fees continues, with representatives from JBPA, the All Island Banana Growers and Elders & Fyffe shipping company making the trek to the negotiating table in the U.K.

There is a threat by the Conservative Government of the U.K. to suspend their bulk buying of Jamaica’s bananas, which was initiated during the war as a protective measure. Experienced industry negotiators including Assistant Manager of the Association R.F. Williams, succeed in preserving the status quo and for the first time since the war, commercial exports resume and British consumers are able to enjoy the high quality Jamaican product again.

After the establishment of the Banana Board (a statutory body that was set up to be the sole purchaser and exporter of Bananas) the industry flourishes for a decade in spite of the pesky Leaf Spot disease.

Herbert Hart, one of the pioneers of the famous Jamaican Tia Maria brand and serving Deputy Manager of the JBPA, is appointed Managing Director and brings his keen understanding of labour relations to the table. Hart is instrumental in charting many important changes during the period including additions to the shipping fleet and oversight of the company’s new acquisitions.

It was now time to methodically and carefully expand the business capabilities of the Company and so a fruit and vegetable business is established in the U.K., starting with the acquisition of several banana ripening concerns. The JP Marketing Company, later renamed JP Fruit Distributors, a subsidiary of JBPA Ltd., is established in the U.K. It is a bold move by a Jamaican owned company and soon proves to be a profitable one.

After almost 50 years of reliable and efficient operations, the last Jamaica Banana Producers Steamship Company vessel sails into harbour from the high seas for the last time. The banana business is nationalised by the Jamaican Government and a new government company the Jamaica Merchant Marine Atlantic takes over the business of banana shipping. However, the JBPA retains its share in this company, demonstrating yet again, its continued commitment to logistics and shipping.

As another decade comes to a close, the banana export business shows signs of decline, from 149 thousand metric tons exported in 1969 to a mere 68 thousand tons in 1979. But this is also a year of change for the JBPA as George Downer, highly respected chartered accountant, is appointed Chairman.

There is also a change at the helm of the company as Dr. Marshall Hall, academic and prominent business executive, assumes the position of Managing Director. Hall goes on to become one of the longest serving Managing Directors with a 25 year stint at the helm.

Under his watch, significant advances in resuscitating the industry take place with the company’s investment in some 3,600 acres of banana estates and a major, successful, diversification thrust.

As Halley’s Comet blazes a trail near to earth, the JBPA star rises with the establishment of St. Mary Banana Estates, then the largest banana estate in Jamaica. A new Chairman, who brings with him solid experience in the fruit and shipping industry, is installed; he is none other than Charles H. Johnston, grandson of one of the founding fathers, Charles E. Johnston.

The eighties prove to be a decade of growth and transformation for the JBPA as three large banana farms are established – Eastern Banana Estates in St. Thomas, Victoria Banana Company in Clarendon and St. Mary Banana Estates which assumes the name of its home parish. JBPA’s diversification into food production and marketing now makes it the largest employer in the English speaking Caribbean.

In 1988, Hurricane Gilbert one of the worst hurricanes to hit the island, devastates the banana industry with the destruction of thousands of acres of bananas. It is the same year, however, that JBPA continues to expand its logistics business. Jamaica Producers Shipping Company is re-formed as a joint venture with the Government of Jamaica and Grace Kennedy and Company Ltd.

The company eventually becomes a wholly owned subsidiary of Jamaica Producers.

This year marks the formation of the European Union, and accelerates the diversification thrust of the Group as a reaction to this new trade regime. JPBA now needs to rebrand in order to reflect its diverse offering. This results in a name change from the historic Jamaica Banana Producers Association to the more inclusive Jamaica Producers Group.

The Group continues its expansion programme with the introduction of JP Foods which produces and markets Jamaican food items.

Just eight years after the first Producers’ banana chips hit the market, the company turns to the Caribbean for the establishment of Antillean Foods Inc. in the Dominican Republic to produce its line of tropical snacks. This allows the company a strategic location from which to distribute to Central America and other Spanish language markets. The move increases output and provides an excellent risk reduction strategy with its dual factory outlets in Jamaica and the Dominican Republic.

In keeping with its history of seizing opportunities, the Company enters the Jamaican snack market with its own brand of banana chips -Jamaica Best.

A new century finds Jamaica Producers gaining recognition as Eastern Banana Estates becomes the first farm in Jamaica and the Caribbean to receive ISO 9002 certification. Determined not to rest on their laurels JP maintains its high standards and in the next years both Eastern Banana Estates Ltd. and St. Mary Banana Estates Ltd. acquire ISO14001 certification as well as EUREGAP, Global Gap and Fairtrade certifications.

As part of its shift to diversify away from bananas JP divests its majority stake of 65% in JP Fruit Distributors Ltd. The UK based banana ripening and fruit distribution company is sold to joint venture partner Dole for some US41.9 million.

With its sterling pioneering efforts in establishing a shipping line, Jamaica Producers continues to put its stamp on the industry in the Caribbean with the purchase of RAM Shipping, a leading freight forwarding business between the UK and the Caribbean. The move makes JP Shipping a fully integrated logistics company.

The milestone coincides with another significant development in the company’s management structure as Jeffrey Hall, succeeds his father Dr. Marshall Hall as Managing Director of Jamaica Producers Group. The younger Hall brings with him 5 years experience working with the JP Group as well as solid business expertise.

After a little over 20 years, JP exits the production of juice in the U.K. and fixes its eye on Holland’s leading fresh juice and smoothie manufacturer. The purchase of Hoogesteger Fresh Specialist B.V. means that the company now has the largest fresh juice company in Europe.

New beginnings also signal the end of old connections as five hurricanes in four years finally take their toll on the company and banana exports to the U.K. cease.

Leading with its core competencies the company joins with Pan Jamaican Investment Trust Ltd. to acquire the business and assets of Mavis Bank Coffee factory Ltd., makers of the highly regarded Jablum brand of famous Blue Mountain Coffee.

It continues to be a bumper year for the company with the introduction of pineapple farming as the first step to becoming a multi crop producer. Subsequently JP adds sweet potatoes as well as cassavas to its farm output.

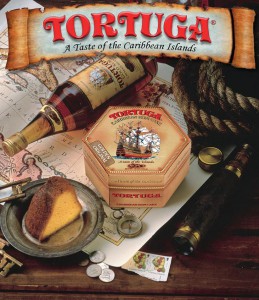

With Jablum and Tortuga now a part of the Group, a third investment one year later sees JP adding a 25% shareholding in Kingston Wharves Limited, to its portfolio. Kingston Wharves is the leading multi-purpose port in the Caribbean. The company is now well positioned for new opportunities, adding value to one of its core businesses.

With the expanded Panama Canal in mind, the company ups the ante and increases its shares in Kingston Wharves to 42% making JP the largest shareholder. The investment is expected to improve the operations and efficiency of the facility in anticipation of an uptake in international cargo operations through the port.

The Group continues to evolve, and after five rewarding years, JP (along with our partner PanJam) exits the coffee business by divesting Mavis Bank Coffee Factory. The divestment creates a significant net gain and return on investment for the benefit of our shareholders.

Following principal investments in Shipping Association of Jamaica Property Limited (SAJPL) in 2015 and 2016, JP acquires an additional stake to bring SAJPL into the fold of the JP group of companies. This investment sees JP continuing its commitment to developing and investing in the Downtown and Newport West area.

JP returns home. The Group relocates its corporate headquarters from New Kingston to the waterfront area of Kingston where our story began in 1929. The move sees JP joining a growing list of significant Jamaican public and private enterprises that are prepared to invest in the infrastructure development and revitalize this important part of our city.

With the goal of combining a strong branded snack product line (JP St Mary’s) with best in class distribution, JP enters a strategic partnership with Wisynco Group Limited in JP Snacks Caribbean Limited. JP Snacks Caribbean, in which Wisynco will own a 30% stake, is a JP subsidiary and holding company that owns the JP St Mary’s brand and snack manufacturing operations.

JP enters into an agreement to sell its interest in SAJE Logistics Infrastructure Limited (formerly Shipping Association of Jamaica Property Limited). The proceeds of the sale will be used to continue to invest in strong Food & Drink and Logistics & Infrastructure businesses. JP will continue to have a smaller shareholding in SAJE through its subsidiary Kingston Wharves.

As a key component of the strategy to continue to strengthen and expand its investment portfolio in Caribbean Logistics and Infrastructure, JP acquires 50% shareholding interest in Geest Line Limited — the leading shipping line connecting Europe to the Caribbean. The Seatrade Group, a global leader in reefer vessel shipping services will hold the remaining 50% interest in the line.

In line with the Group’s strategic plan to develop major new markets in Europe for fresh juice, JP acquires a 50% interest in CoBeverage Lab S.L. (CBL), a fresh juice producer located in Barcelona, Spain. CBL serves a range of customers in southern Europe and will target opportunities in that market.

Yet another investment opportunity in 2021 sees JP establishing Grupo Frontera Limited, a 50/50 holding company with Norbrook Equity Partners, which acquires the assets and operations of Grupo Alaska, a leading water and ice company in the Dominican Republic. This acquisition is another step in JP’s strategy to strengthen and expand its investment portfolio in food and drink, with a focus on Spanish language consumers in the Caribbean.

JP’s UK-based subsidiary, JP Shipping Services Limited, acquires Miami Freight & Shipping Services Limited, a Florida-based company engaged in freight handling, logistics and shipping for over 40 years. This addition to the Group’s shipping and logistics portfolio marks an important expansion of JP’s diversified logistics and shipping platform that connects the world’s major markets to the Caribbean.

Jamaica Producers Group Limited, JP, and PanJam Investment Limited, PanJam announce the successful completion of their amalgamation which was was approved by the shareholders of both companies on December 22, 2022. With effect from April 1, 2023, PanJam will change its name to Pan Jamaica Group and will hold the combined businesses.

The agreement between the two Jamaican conglomerates, saw JP transfer its material businesses to PanJam in exchange for JP receiving a 34.5% per cent ownership stake in PanJam.

The amalgamation created a formidable player in the Jamaican investor landscape with diverse interests in real estate and infrastructure, specialty food and drink manufacturing, agri-business, financial services and a global services network of interests in hotels and attractions. Pan Jamaica Group will have assets of over J$100 billion and will leverage the strength of both groups of businesses to expand their reach and create new opportunities for growth.